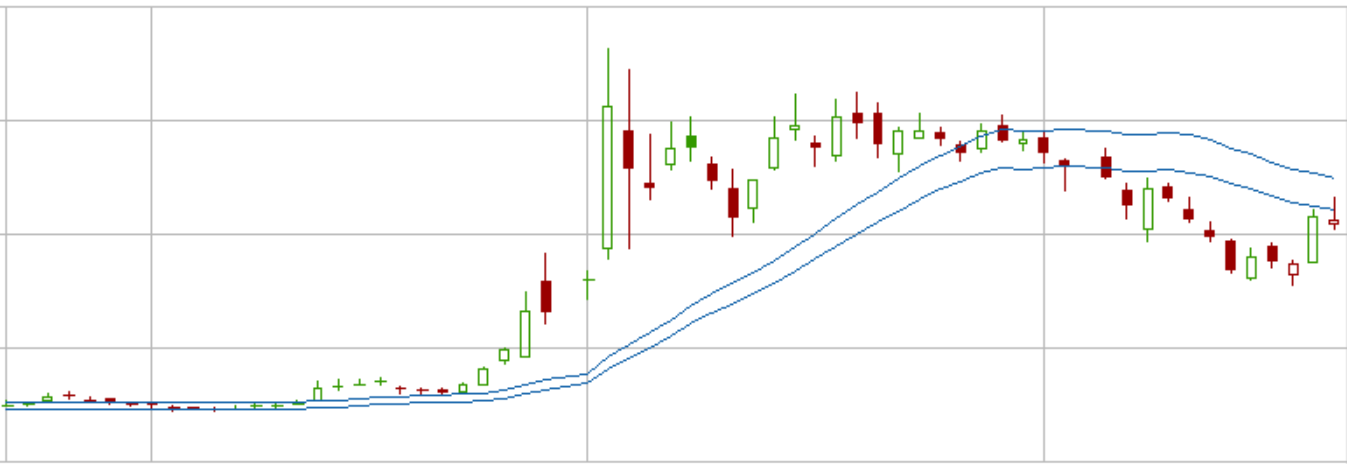

# Market Behavior and Trading Strategies Markets trend and markets mean revert. Today we’re going to explore what those mean. Then we will give an overview of how some trading strategies seek to profit from this market behavior. With an understanding of mean reversion and trend, you can choose trading plans that are consistent with your personal trading psychology. If this is your first visit to [Savage Corner](https://www.savagecorner.io/p/mean-reversion-vs-trend), or this was forwarded to your email, please subscribe to keep the finance knowledge flowing. Remember, knowledge enables opportunities! ## Mean Reversion  <center>Look at how price moves up and down but keeps reverting back to mean</center> <br> Historical prices have a central ‘pressure’. Sometimes this is measured with moving averages. If the price gets too high above that, or too far below it, it reverts back to the mean. So you can think of that mean as being like gravity. Sometimes markets break the force of gravity, and they . . . ## Trend!  <center>Holy moly, how fast did that move?!!?</center> <br> Just like a rocket needs a certain amount of momentum or escape velocity to break the force of gravity and escape from the gravity well, markets may need extra force to escape from the mean reversion gravity and break into a trend. So when markets go into a trend, the trend can move swiftly and violently. Eventually, gravity kicks in and the trend starts to peter out. Then it will wobble and potentially crash down to earth. In some cases, if the fundamentals have changed, then price will find a new gravity, and it won't crash all the way back down to where it was before. But somewhere in between. ## Trading Styles Most trading systems are designed around either mean reversion or trend. Fundamentals driven value investing systems are looking for things that are under valued. There's an assumption that ‘underpriced’ stocks will mean revert back up, because they're priced too far below their value. So value investing is at heart inherently a mean reversion powered strategy.  <center>Support & resistance can be identified many ways! I like to use channels, where Support is around the bottom line and Resistance is around the top line.</center> <br> Range trading uses support and resistance zones. Support and resistance are like the edges of the gravity zone. When price looks like it's coming up off of support, you can buy the asset. Then if it gets close to resistance and you think is going to reverse back down again you sell (or sell short) the asset. That's a mean reverting strategy. There's a trading range and it bounces back and forth within the range because the mean is somewhere in the middle of the range. If your strategy is oriented around it breaking out from these trading ranges, and taking off, that’s a trend strategy. You buy the trend and you try to ride the trend as long as you can. ## Which Should I Use? Mean reversion strategies and trend strategies are effective in different market conditions, but their profitability depends on effective execution. That’s dependent on your skills and psychology. Mean reverting strategies tend to be the strategies that people learn first. It's easy to look at a chart and say this is a support zone, so I think that it's not going to drop below this. I'm going to put a stop loss just below the support zone in case I'm wrong. I can see where this resistance zone is and if it does mean revert, it's going to pop back up to the resistance. I have a stop loss just below support, and I have a profit target that's up by the resistance, and I can calculate the risk reward ratio. I can say, oh, that's a three to one risk reward ratio. Which means if I take that trade 100 times and I'm right half the time, then I lose 25% and I Gain 75% and I end up making two to one on my risked money. Trend strategy requires a bit more faith on the part of the trader, because you can't see the potential if the trend breaks out. Maybe your buying rule is to buy when it breaks out from former all time highs. It could dribble above the highs a little bit and then go back into mean reversion or it could run. But the reality is that for an asset to hit new all time highs it has to break out of previous all time highs — kind of by definition. And the trend can always run further than you think. So investors that are comfortable with building risk models around it can find a great deal of success with trending strategies where they buy breakouts or sell breakdowns. And ride the trend as long as it continues to trend. And when it wobbles and looks like it's going back into mean reversion jump off the trend and go find something else trending. And so there are a lot of strategies designed around that. Value investing starts out as a mean reversion strategy. But the idea is you catch the first mean reversion and then hold it through the breakout, and try to ride the first trend or two. Then when it seems to be overvalued and looks likely to go back into mean reversion, then you sell. So if you can catch trades that start out as a mean reversion and become trend and then carry them all the way until they go back into mean reversion. . . It's a longer trend and potentially more profitable. It also requires catching the first mean reversion correctly, or having the fortitude to keep building a position until the initial move begins in your favor. When you start getting into market maker strategy for liquidity pools in DeFi, the same principles apply. Since you capture fees during mean reversion periods, that can boost your yield. If you catch a trend, you’ll see some value appreciation, but you’re going to have some ‘impermanent loss’ — a DeFi way of saying that in a trend market you might be better off holding outright than holding in a liquidity pool. On the other hand, if there are incentives in place to encourage LP’s (yield farming), that can offset any impermanent loss and even take the edge off catching the beginning of a downtrend. It’s still a good idea to get out if you see the market going into a downtrend. # Summary The purpose of this post is just to give an overview and help you recognize whether strategies are mean reversion strategies or trend strategies. From there, you can begin to think about whether that strategy, and the psychology required to stick to it, is consistent with your psychology and your overall view of the market. [Cross-posted from Savage Corner. Please subscribe to never miss a post!](https://www.savagecorner.io/p/mean-reversion-vs-trend)

| post_id | 93,149,411 |

|---|---|

| author | josephsavage |

| permlink | mean-reversion-vs-trend |

| category | hive-152587 |

| json_metadata | {"tags":["trading","markets","crypto","equities","finance","education"],"image":["https:\/\/images.hive.blog\/DQmX1HFjjh75quWAMvrePUnaA7SRGjTpJ29qBozesSAy1cz\/mean-reversion.png","https:\/\/images.hive.blog\/DQmW8HszwE3vESiXBuoyzFX3QyvJQNdZVi7iLCj9goMWSWk\/trend.png","https:\/\/images.hive.blog\/DQmaJg1eDmzc1P3ruwPvEhGbUMPc9ZF2e1AgDw1zTHLkooe\/trading-channel.png"],"links":["https:\/\/www.savagecorner.io\/p\/mean-reversion-vs-trend"],"app":"steemit\/0.2","format":"markdown"} |

| created | 2021-08-09 14:32:27 |

| last_update | 2021-08-09 14:32:27 |

| depth | 0 |

| children | 11 |

| net_rshares | 3,684,817,252,296 |

| last_payout | 2021-08-16 14:32:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 1.260 SBD |

| curator_payout_value | 1.207 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 6,903 |

| author_reputation | 28,840,315,031,266 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| funnel | 0 | 12,894,416,286 | 100% | ||

| dune69 | 0 | 1,454,429,757 | 100% | ||

| whitelightxpress | 0 | 13,972,130,819 | 100% | ||

| georgestefanb | 0 | 0 | 100% | ||

| mnur | 0 | 0 | 100% | ||

| drax | 0 | 32,853,462,148 | 9% | ||

| rayne122 | 0 | 0 | 100% | ||

| albanna | 0 | 0 | 100% | ||

| qurator | 0 | 40,894,730,672 | 6.46% | ||

| steembasicincome | 0 | 1,322,345,449,819 | 100% | ||

| fullcoverbetting | 0 | 5,661,325,773 | 100% | ||

| thegreenfox | 0 | 0 | 100% | ||

| simpleslife | 0 | 0 | 100% | ||

| harikesh | 0 | 0 | 100% | ||

| sbi2 | 0 | 651,368,224,043 | 100% | ||

| abdullahj | 0 | 0 | 100% | ||

| buchitus | 0 | 0 | 100% | ||

| sbi3 | 0 | 425,406,237,079 | 100% | ||

| sbi4 | 0 | 335,414,768,302 | 100% | ||

| curatorcat | 0 | 41,574,619,678 | 100% | ||

| sbi5 | 0 | 226,862,014,722 | 100% | ||

| team-cn | 0 | 16,672,636,579 | 8% | ||

| sbi6 | 0 | 165,598,832,762 | 100% | ||

| sbi7 | 0 | 131,970,301,275 | 100% | ||

| hugohugo | 0 | 0 | 100% | ||

| cliffagreen | 0 | 9,844,753,708 | 100% | ||

| sbi8 | 0 | 98,252,702,979 | 100% | ||

| sbi9 | 0 | 74,564,079,728 | 100% | ||

| nurseanne84 | 0 | 11,001,383,615 | 100% | ||

| sbi10 | 0 | 57,295,700,769 | 100% | ||

| tramelibre | 0 | 7,753,366,686 | 100% | ||

| fyjs | 0 | 0 | 25% | ||

| floglau20 | 0 | 0 | 100% | ||

| shahab021 | 0 | 0 | 100% | ||

| lianaayuliana | 0 | 1,161,685,097 | 100% | ||

| bechibenner | 0 | 0 | 100% | ||

| edibless | 0 | 0 | 100% | ||

| nikita201 | 0 | 0 | 100% | ||

| sofiyana123 | 0 | 0 | 100% |

please support me...?? [WhereIn Android] (http://www.wherein.io)

| post_id | 94,650,948 |

|---|---|

| author | abdullahj |

| permlink | wherein-1633922993645 |

| category | hive-152587 |

| json_metadata | {} |

| created | 2021-10-11 03:29:57 |

| last_update | 2021-10-11 03:29:57 |

| depth | 1 |

| children | 0 |

| net_rshares | 0 |

| last_payout | 2021-10-18 03:29:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 66 |

| author_reputation | 18,290,358,680,145 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

!sbi status?

| post_id | 98,091,407 |

|---|---|

| author | freedomno1 |

| permlink | r8qkmi |

| category | hive-152587 |

| json_metadata | {"app":"steemit\/0.2"} |

| created | 2022-03-14 13:11:06 |

| last_update | 2022-03-14 13:11:06 |

| depth | 1 |

| children | 1 |

| net_rshares | 945,860,977 |

| last_payout | 2022-03-21 13:11:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 12 |

| author_reputation | 2,159,953,712,811 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| freedomno1 | 0 | 879,812,946 | 100% |

Hi @freedomno1! * you have 2 units and 0 bonus units * your rshares balance is 276558107994 or 0.135 $ * your next SBI upvote is predicted to be 0.045 $ Structure of your total SBI vote value: * 71.91 % has come from your subscription level * 0.00 % has come from your bonus units * 23.34 % has come from upvoting rewards * 4.75 % has come from new account bonus or extra value from pre-automation rewards <br> Take Control! Include `#sbi-skip` in your text to have us skip any post or comment.

| post_id | 98,091,414 |

|---|---|

| author | sbi6 |

| permlink | re-r8qkmi-20220314t131206z |

| category | hive-152587 |

| json_metadata | {"app":"steembasicincome\/0.1.2"} |

| created | 2022-03-14 13:12:06 |

| last_update | 2022-03-14 13:12:06 |

| depth | 2 |

| children | 0 |

| net_rshares | 927,617,739 |

| last_payout | 2022-03-21 13:12:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 498 |

| author_reputation | 5,011,872,336,272 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| freedomno1 | 0 | 861,485,541 | 100% |

!sbi status [WhereIn Android] (http://www.wherein.io)

| post_id | 101,116,452 |

|---|---|

| author | white-bai |

| permlink | wherein-1663453674069 |

| category | hive-152587 |

| json_metadata | {} |

| created | 2022-09-17 22:27:57 |

| last_update | 2022-09-17 22:27:57 |

| depth | 1 |

| children | 1 |

| net_rshares | 0 |

| last_payout | 2022-09-24 22:27:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 54 |

| author_reputation | 67,091,370,995,541 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

Hi @white-bai! * you have 41 units and 0 bonus units * your rshares balance is 221531760153 or 0.086 $ * you need to wait until your upvote value (current value: 0.029 $) is above 0.041 $ Structure of your total SBI vote value: * 98.64 % has come from your subscription level * 0.00 % has come from your bonus units * 0.00 % has come from upvoting rewards * 0.00 % has come from new account bonus or extra value from pre-automation rewards <br> Take Control! Include `#sbi-skip` in your text to have us skip any post or comment.

| post_id | 101,116,460 |

|---|---|

| author | sbi6 |

| permlink | re-wherein-1663453674069-20220917t222926z |

| category | hive-152587 |

| json_metadata | {"app":"steembasicincome\/0.1.2"} |

| created | 2022-09-17 22:29:27 |

| last_update | 2022-09-17 22:29:27 |

| depth | 2 |

| children | 0 |

| net_rshares | 0 |

| last_payout | 2022-09-24 22:29:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 532 |

| author_reputation | 5,011,872,336,272 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

!sbi status

| post_id | 102,289,994 |

|---|---|

| author | levi-miron |

| permlink | rnrl18 |

| category | hive-152587 |

| json_metadata | {"app":"steemit\/0.2"} |

| created | 2022-12-31 16:41:36 |

| last_update | 2022-12-31 16:41:36 |

| depth | 1 |

| children | 1 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:41:36 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 11 |

| author_reputation | 19,850,789,211,926 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

Hi @levi-miron! * you have 13 units and 0 bonus units * your rshares balance is 381822090325 or 0.139 $ * you need to wait until your upvote value (current value: 0.035 $) is above 0.039 $ Structure of your total SBI vote value: * 88.35 % has come from your subscription level * 0.00 % has come from your bonus units * 0.00 % has come from upvoting rewards * 0.00 % has come from new account bonus or extra value from pre-automation rewards <br> Take Control! Include `#sbi-skip` in your text to have us skip any post or comment.

| post_id | 102,290,005 |

|---|---|

| author | sbi5 |

| permlink | re-rnrl18-20221231t164259z |

| category | hive-152587 |

| json_metadata | {"app":"steembasicincome\/0.1.2"} |

| created | 2022-12-31 16:43:00 |

| last_update | 2022-12-31 16:43:00 |

| depth | 2 |

| children | 0 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:43:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 532 |

| author_reputation | 5,754,399,373,371 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

!sbi status

| post_id | 102,289,998 |

|---|---|

| author | barmbo |

| permlink | rnrl2o |

| category | hive-152587 |

| json_metadata | {"app":"steemit\/0.2"} |

| created | 2022-12-31 16:42:30 |

| last_update | 2022-12-31 16:42:30 |

| depth | 1 |

| children | 1 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:42:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 11 |

| author_reputation | 71,340,037,507,125 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

Hi @barmbo! * you have 474 units and 0 bonus units * your rshares balance is 1472730972924 or 0.537 $ * your next SBI upvote is predicted to be 0.134 $ Structure of your total SBI vote value: * 96.01 % has come from your subscription level * 0.00 % has come from your bonus units * 3.93 % has come from upvoting rewards * 0.06 % has come from new account bonus or extra value from pre-automation rewards <br> Take Control! Include `#sbi-skip` in your text to have us skip any post or comment.

| post_id | 102,290,017 |

|---|---|

| author | sbi8 |

| permlink | re-rnrl2o-20221231t164351z |

| category | hive-152587 |

| json_metadata | {"app":"steembasicincome\/0.1.2"} |

| created | 2022-12-31 16:43:51 |

| last_update | 2022-12-31 16:43:51 |

| depth | 2 |

| children | 0 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:43:51 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 495 |

| author_reputation | 4,254,895,407,768 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

!sbi status

| post_id | 102,290,008 |

|---|---|

| author | kirstin |

| permlink | rnrl3n |

| category | hive-152587 |

| json_metadata | {"app":"steemit\/0.2"} |

| created | 2022-12-31 16:43:03 |

| last_update | 2022-12-31 16:43:03 |

| depth | 1 |

| children | 1 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:43:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 11 |

| author_reputation | 69,183,097,091,893 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |

Hi @kirstin! * you have 410 units and 0 bonus units * your rshares balance is 1278636991167 or 0.466 $ * your next SBI upvote is predicted to be 0.117 $ Structure of your total SBI vote value: * 96.79 % has come from your subscription level * 0.00 % has come from your bonus units * 3.20 % has come from upvoting rewards * 0.01 % has come from new account bonus or extra value from pre-automation rewards <br> Take Control! Include `#sbi-skip` in your text to have us skip any post or comment.

| post_id | 102,290,021 |

|---|---|

| author | sbi4 |

| permlink | re-rnrl3n-20221231t164443z |

| category | hive-152587 |

| json_metadata | {"app":"steembasicincome\/0.1.2"} |

| created | 2022-12-31 16:44:42 |

| last_update | 2022-12-31 16:44:42 |

| depth | 2 |

| children | 0 |

| net_rshares | 0 |

| last_payout | 2023-01-07 16:44:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 SBD |

| curator_payout_value | 0.000 SBD |

| pending_payout_value | 0.000 SBD |

| promoted | 0.000 SBD |

| body_length | 496 |

| author_reputation | 6,573,214,094,059 |

| root_title | "Mean Reversion vs Trend" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 SBD |

| percent_steem_dollars | 10,000 |