<center><img src='https://scontent-cdg2-1.cdninstagram.com/vp/8694d928f636a57a46f38923efcbfc26/5C9CE6C8/t51.2885-15/e35/45577387_337674093496720_1557062838581785559_n.jpg'></center><br /> #cryptocurrencynews @altcoindaily ・・・ Surprisingly, amid one of the worst Bitcoin corrections in its decade-long history, a number of commentators and investors, from the traditional, venture, and crypto realms alike, have come out in full support of this asset class and ground-breaking innovation. The most recent of these notable outspoken supporters is one Jeff Sprecher, CEO of the Intercontinental Exchange (ICE), who took to CoinDesk’s Consensus Invest event on Tuesday to discuss his opinions on the crypto market. Speaking at the popular New York event, which hosted the crypto industry’s leading innovators, analysts, and executives, Sprecher spoke on if he believes that digital assets will survive, especially considering the market’s most recent drastic downturn. Responding to the self-imposed question, the ICE chief, known for having a penchant for innovation and acceptance, noted that he would say “the unequivocal answer is yes,” before adding that the tumultuous value of crypto assets hasn’t irked his view on the matter. —— 🤔Are you feeling bullish or bearish on crypto's potential future? 🗣Let us know in a few words! —— 🤩Follow @altcoindaily —— #ice #segwit #segwit2x #bitcoincash #eth #btc #cryptocurrency #ico #ai #smartcontracts #initialcoinoffering #ethereum #ether #bitcoin #altcoin #litecoin #cryptonaire #sharecrypto #blockchain #coinbase #steemit #monero #bitcoins #cryptocurrencies #share2steem<br /> <center><img src='https://i.imgur.com/hkAaP5z.png' /></center><br /> <center><a href='https://www.instagram.com/shaneelsomduth/'><img src='https://scontent-cdg2-1.cdninstagram.com/vp/57c0006652d8306930a91818e156e190/5CA2C54B/t51.2885-19/s150x150/17076914_1831682307071832_8421482066230640640_a.jpg'> shaneelsomduth</a></center> <center><img src='https://i.imgur.com/hkAaP5z.png' /></center><br /> <center><sup>Posted from <a href='https://www.instagram.com/p/BqvPgDcFzc5'>Instagram</a> via <a href='https://www.share2steem.com/?ref=shanzo'>Share2Steem</a></sup></center>

X11 Algorithm The SegWit2x protocol has entirely different specifications from Bitcoin. Our network is secured using X11 algorithmrather than SHA-256. It consists of all 11 SHA3 contestants, each hash is calculated and then submitted to the next algorithm in the chain. By utilizing multiple algorithms a system similar to ASIC (Application Specific Integrated Circuits) is created. The first Bitcoin miners started using CPUs (Central Processing Units), then they switched to GPUs (Graphics Processing Units) and ASIC quickly replaced the latter ones proving to be the most convenient mechanism. Due to the complexity and the needed size required to create an ASICfor mining X11, it takes considerably longer than in Bitcoin. It means that mining activity lasts for a longer period of time. SegWit2X team deeply believes that it’s highly important for good distribution and growth of B2X. Moreover, the implemented X11 algorithm also provides a better network security. The mining costs are also reduced because the mining equipment consumes 30% less electrical power, mining equipment serve longer.  Lightning Network:It allows transactions over a “second-layer solution”. It means that the part of the transaction moves off the blockchain network. Such an improvement solves the scalability problem of Bitcoin when some information is stored in separate files outside the chain of blocks. The vacant space of the target block accommodates more transactions and the speed of confirmation is eventually increased.

<center>https://journalducoin.com/wp-content/uploads/2018/06/Bitcoin.org_.jpg</center> <br/><strong>Il y a un peu plus d’un mois, le site officiel de Bitcoin annonçait s’apprêter à changer de design. C’est désormais chose faite, et <a href="https://journalducoin.com/bitcoin/bitcoin-org-change-de-design/">leur site a fait peau neuve il y a un peu moins d’une semaine</a>. Au passage, les équipes de <a href="https://bitcoin.org/fr/">Bitcoin.org</a> en ont profité pour supprimer de leur site toutes les mentions faites à certains acteurs de l’industrie, dont notamment <a href="https://journalducoin.com/tag/coinbase/">Coinbase</a> et <a href="https://journalducoin.com/tag/bitpay/">Bitpay</a>.</strong><br><center><hr><em>Continuer la lecture : <a href="https://journalducoin.com/exchange/bitcoin-org-supprime-coinbase-et-bitpay/">https://journalducoin.com/exchange/bitcoin-org-supprime-coinbase-et-bitpay/</a></em><hr></center>

https://crushthestreet.com/wp-content/uploads/2018/05/Consensus-2018-is-Coming-%E2%80%93-What-Does-This-Mean-for-the-Plummeting-Crypto-Prices-750x400.jpg #### **The Biggest Event in Blockchain Tech** It’s going to be a big week in blockchain tech next week, as [Consensus 2018](https://www.coindesk.com/events/consensus-2018/) is a three-day conference located in New York with all the biggest movers and shakers in the space attending, speaking, and networking. Consensus is hosted by [Coindesk](https://www.coindesk.com/), with over 250 speakers and 7,000 people attending from a wide range of different industries, including finance and technology. The event is often seen as a bullish influencer on the markets, with altcoins in particular historically increasing in price around the time of the conference. Consensus has been host to monumental events in blockchain tech, such as the [SegWit2x agreement](https://crushthestreet.com/articles/digital-currencies/segwit-september-bitcoins-community-reaches-agreement-scaling-hold-luke-dodwell) that took place during the previous event, Consensus 2017. https://crushthestreet.com/wp-content/uploads/2018/05/Consensus-2018-Is-Coming-%E2%80%93-What-This-Means-For-The-Plummeting-Crypto-Prices.jpg **Market Pullback Before the Conference** Despite many pinning hopes on Consensus to push Bitcoin back above $10,000, a perfect storm of [Mt Gox trustee updates](https://crushthestreet.com/articles/digital-currencies/400-million-worth-bitcoin-dumped-sec-warnings-binance-attacked), [fake SEC news](https://crushthestreet.com/articles/digital-currencies/sec-cftc-hearing-ethereum-happen-fud-fake-news-reigning-supreme), and overall FUD triggered yet another pullback, with Bitcoin and Ethereum both down over 10% from last week’s prices. If that wasn’t enough, household names like Warren Buffett and Bill Gates have spoken against Bitcoin, which many believe also contributed to the latest pullback. _“In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending.” – _[Warren Buffet](https://www.cnbc.com/2018/05/05/warren-buffett-says-bitcoin-is-probably-rat-poison-squared.html)t _“I would short it if there was an easy way to do it.” – _[Bill Gates](https://www.cnbc.com/video/2018/05/07/munger-bitcoin-is-worthless-artificial-gold.html) Interestingly, Bill Gates was always known as being extremely bullish on cryptocurrencies, the underlying blockchain technology, and the untapped potential to bank the “unbanked.” It will be interesting to see if he does attempt to short Bitcoin! https://crushthestreet.com/wp-content/uploads/2018/05/Consensus-2018-Is-Coming-%E2%80%93-What-This-Means-For-The-Plummeting-Crypto-Prices2.jpg Many enthusiasts now look to the historic trends to recover the prices. Will the biggest Consensus conference to date be able to repeat history and bring back the bullish sentiment? Only time will tell how it influences the markets, as anything can happen in this new and volatile digital ecosystem. **Disclaimer: Only invest what you are willing to lose. Do not place your hopes on one event happening, and always do your own research!** ## [Written by Luke Dodwell for CrushTheStreet.com 2018-05-13](https://crushthestreet.com/articles/digital-currencies/consensus-2018-coming-plummeting-crypto-prices) - @lukedaniel

https://coingyan.com/wp-content/uploads/2018/02/What-is-UASF-and-BIP-in-Bitcoin-Everything-You-need-to-Know-1078x516.jpg --- Many of you might be aware of something known as a <a href="https://coingyan.com/bitcoin-gold-hard-fork-everything-want-know/"><strong>bitcoin fork</strong></a>. There has already been a lot of debate going on in the crypto world about this specific topic. However, many people and especially noobs to the crypto world might have heard about this thing called a <strong>UASF</strong> and <strong>BIP</strong> and been like whatttt. What are those? So if you happen to be on the flip side of things here, then I this post might be the place where you will say I know what those terms mean, after reading it. And then be like “Now I can be a part of these discussions and sound smart like other people.” Lol.</p> <p>Alright, so let us dig in shall we?</p><center><div class="coing-content-1" style="text-align: center; " id="coing-1822907353"><a href="https://coingyan.com/go/ledger-nano-s/"><img width="300" height="300" src="https://coingyan.com/wp-content/uploads/2017/09/ledgerwallet.gif" alt="Ledger Nano S" title="ledgerwallet"></a></div></center> <h2><span id="What_is_UASF">What is UASF</span></h2> <p><strong>UASF</strong> is an acronym that stands for User Activated Soft Fork regarding bitcoin.</p> <p>It was supposed to be an initiative to activate a <a href="https://coingyan.com/bitcoin/">bitcoin</a> soft fork at a particular date and administered by a majority of full nodes rather than depending on miners. However, for achieving success in their endeavors participating nodes should have been a part of a so-called “economic majority,” i.e., users, exchanges and businesses with a significant hold over the bitcoin economy.</p> <p>Earlier, a UASF was efficiently carried out to activate the <strong>P2SH</strong> soft fork. On Feb 25, 2017, an unknown or rather a secret contributor named <em>Shaolin Fry</em> suggested that UASF is used to enable Segregated Witness and later on published details in BIP148.</p> <p>Additional info: UASF is also occasionally misspelled as USAF. USAF is not a standard acronym for anything concerning bitcoin or blockchain technologies. A UASF needs the coordination of 3 things: developer, industry, and user.</p> <p>Alright, so now that we have some basic knowledge about UASF let us move on to the next thing that is a BIP. Then you guys can flaunt your knowledge to other noobs and probably direct them here as well. Lol.</p> <h2><span id="What_is_a_BIP_in_Bitcoin">What is a BIP in Bitcoin</span></h2> <p><strong>BIP</strong> is the short form of Bitcoin improvement proposal.</p> <p>According to <a href="https://en.bitcoin.it/wiki/Main_Page">Bitcoin </a>wiki , ” A Bitcoin Improvement Proposal (BIP) is a design document for introducing features or information to Bitcoin. The BIP should not only provide a concise technical specification of the element but also a rationale for this proposed feature. This is the conventional way of communicating ideas since Bitcoin has no formal structure.</p> <p>The first BIP (BIP 0001) was submitted by <em><strong>Amir Taaki</strong></em> on 2011-08-19 and described what a BIP is.”</p> <p>Now a majority of you reading this post might be aware of the fact that any single entity or company does not govern Bitcoin, and it is because of this very fact that Bitcoin seems to be having no formal structure for proposing improvements in its protocol.</p> ## [ Read The Complete Post: What is UASF and BIP in Bitcoin: Everything You Need to Know](https://coingyan.com/uasf-bip-bitcoin-everything-need-know/) --- [This post also published on our Official Site](https://coingyan.com/uasf-bip-bitcoin-everything-need-know/) --------- ## [Vote for @JatinHota (Founder of CoinGyan) as a witness](https://v2.steemconnect.com/sign/account-witness-vote?witness=jatinhota&approve=1) <hr> ### [Click this link](https://v2.steemconnect.com/sign/account-witness-vote?witness=jatinhota&approve=1) and input your active private key when asked to vote <hr> Alternatively, You can vote for me here: https://steemit.com/~witnesses Go to the witness page https://steemit.com/~witnesses Scroll down and Type "jatinhota" into the box (without the quotes and @), and then click the vote button: <p><a href="https://steemit.com/~witnesses"><img src="https://steemitimages.com/DQmYdRFyqzdtweCnPdQ9HuPgi6zdoupK6GSJ8SV4wbUsz6S/2017-10-01_13-39-51-1.gif" alt="Vote Jatin Hota Steem Witness" width="100" height="100" border="0" /> </a></p> or Set me As Proxy <p><a href="https://steemit.com/~witnesses"><img src="https://steemitimages.com/DQmQiBbqkZnp32BNUoqqBiS9vdGuJggnUCnQxi1zaA8AfSD/2017-10-01_13-52-52.gif" alt="Vote Jatin Hota Steem Witness" width="100" height="100" border="0" /> </a></p> If I am on the top 50 witnesses, you'll be able to vote for @JATINHOTA simple my clicking upvote symbol the beside jatinhota. <hr> --- --- ##### Have An Idea? Want to Chat with me or Need Support? You can Directly Chat with him in [Steemit.chat](https://steemit.chat/direct/jatinhota) or [Discord #IndiaUnited](https://discord.gg/vPZcE6Y) <center><p><a href="https://discord.gg/vPZcE6Y"><img src="https://steemitimages.com/DQmPZEFsaVoaRKVEbYubfEWLznWSFqfxPjbE73EaGvV2dt4/IU-SIGN.png" alt="IndiaUnited Discord" width="100" height="100" border="0" /> </a></p> --- ### <center>Thank you for reading it.</center> <center></center>

Cuando Bitcoin se propuso por primera vez en 2008, fue revolucionario. Por primera vez, la gente podía confiar en una divisa sin un banco o gobierno detrás de ella. Año 2018, el Bitcoin vuelve a estar muy por encima de los 10.000 USD y más del 87% de las personas han oído hablar de él.  Bitcoin tiene casi una década. Ahora hay más de 1.500 criptomonedas más nuevas que Bitcoin, más eficientes, más rápidas y que ofrecen características de las que Bitcoin carece. En el último mes, el porcentaje del mercado de Bitcoin cayó del 56% al 33%. Bitcoin ha realizado el duro trabajo de abrir la brecha, mantenerse a la delantera no le será fácil. ## Arreglando “aquí y allá” El primer detalle que enfrenta Bitcoin es su lentitud. La red Bitcoin sólo puede manejar 7 transacciones por segundo. En comparación Visa maneja 24.000 transacciones por segundo en promedio, y, en teoría, puede con hasta 56.000. Segundo, es caro. La congestión de la red, entre otras cosas, genera tarifas extraordinariamente altas. Los honorarios a fines de diciembre de 2017 fueron de US$ 37 por transacción, más que el costo de una transferencia bancaria. Por último, su versatilidad. Bitcoin fue diseñado como una moneda digital. Su tecnología sólo permite programación básica. Blockchains programables, como Ethereum, tienen el potencial de impactar una gama más amplia de sectores. ## Criptomonedas 2.0: la Nueva Generación Muchas de las nuevas monedas sobrepasan las capacidades actuales de Bitcoin. Veamos a algunas de las más sobresalientes: Stellar Lumens (XLM). Puede manejar 1.000 transacciones por segundo sin perder el control y transferir millones de dólares por unos pocos centavos. RaiBlocks / NANO (XRB). De las más recientes. Ofrece una altísima escalabilidad, transacciones inmediatas y cero comisiones. Esto gracias a su arquitectura basada en gráficos acíclicos. EOS. Sus desarrolladores van por un blockchain completamente programable, operaciones gratuitas y capacidad de procesar millones de transacciones por segundo. ## Knock-knock… ¿Bitcoin? Por ahora no hay consenso para Segwit2x, y Lightning Network, la respuesta de la red Bitcoin a sus perseguidores, está en pruebas. Por lo pronto, empresas emergentes como EOS, XLM y XRB vienen listas, con su velocidad y funcionalidad, para ocupar puestos de vanguardia en el criptomundo. Sí, Bitcoin, vienen por ti. https://criptotendencia.com/2018/03/01/hey-bitcoin-que-vas-a-hacer-cuando-vengan-por-ti/

As a result of the latest Bitcoin Core 0.16 update, the usage levels of Bitcoin SegWit have been taking off. This significant uptick in usage levels can also be attributed to a number of major exchanges and wallet providers such as Coinbase and Bittrex finally implementing this technology into their platforms. This uptick means that there could be a significant decrease in global bitcoin transaction fees and times. The Advantage Segregated Witness (SegWit) is a way of bundling transaction together into blocks, which is a much more efficient way for transactions to be processed. The Bitcoin network has experienced high levels of congestion since its popularity exploded in 2017, with issues abound as to how to scale the network. This led to higher fees and slower transaction times which were turning a lot of people away from using Bitcoin. The adoption of SegWit is aimed at drastically reducing this level of congestion. The main issue that has been holding back the widespread adoption of SegWit across the space is that it has to be specifically enabled on wallets and exchanges. This means you need to have specific SegWit wallet addresses and these cannot be used to bridge non-SegWit and SegWit transactions. Growing Adoption Thankfully, the adoption levels of this technology have been growing rapidly in recent days due to the new update and the adoption by exchanges. The use of SegWit as a percentage of total daily bitcoin transaction had been averaging around the 15% mark for some time up until last week when these events have caused a steady uptick in adoption levels. In the past 24 hours alone, SegWit usage levels have hit peak levels of adoption at the 30% of total Bitcoin transactions mark. Monday the 26th of February saw the release of the latest Bitcoin Core update labeled v0 16.0 and this provided full support to SegWit scaling technology. There are other improvements that have been made as part of this update, but SegWit support and adoption is the major aspect that most people are focusing on. Since SegWit was initially released in August 2017, widespread adoption of this technology has been something that Bitcoin users have been constantly requesting. While a lot of the significant wallet provides and exchanges have taken their time implementing this technology, eventually growing pressure from their users as a result of slow transaction times and high fees pushed them to do something. This adoption will also lead to further significant improvements to Bitcoin in the future, such as the implementation of the Lightning Network which might allow transaction times and fees to trend close to zero. This is an exciting time for Bitcoin and cryptocurrencies as a whole as a breath of fresh air has been blown into the markets, with prices reacting positively to this news.

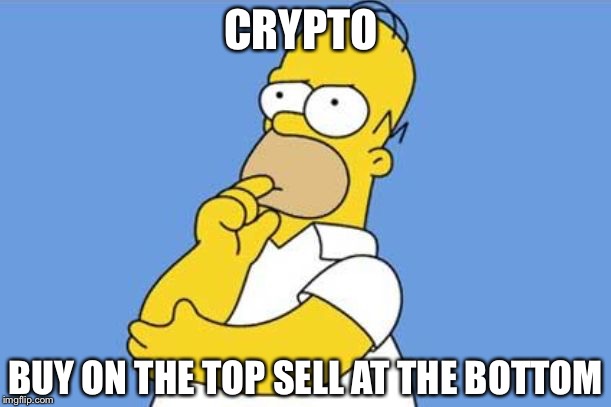

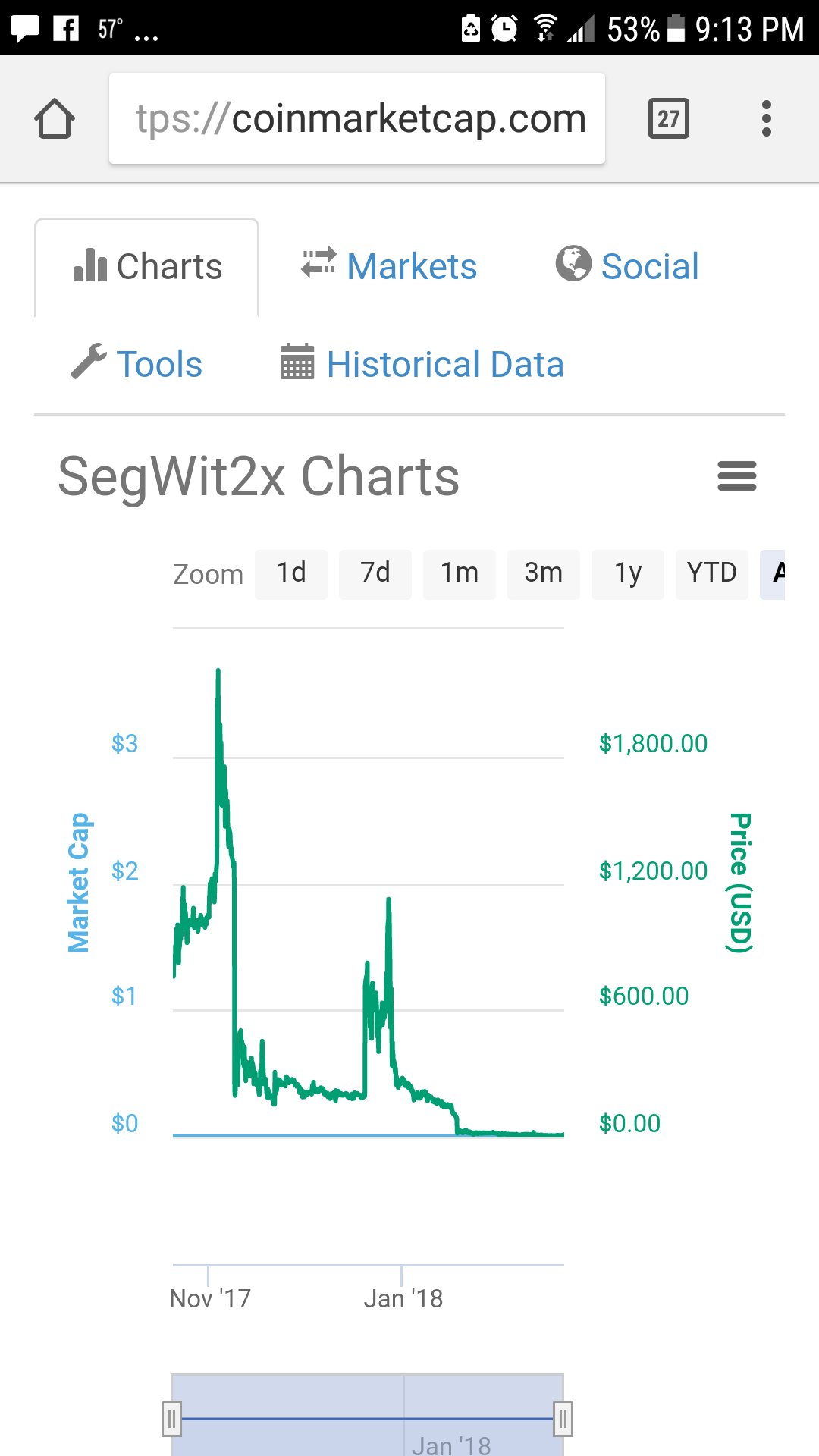

I posted this in my blog already but i dont know how to transfer that post here.. if im breaking any rules mods/admins please let me know... So anyways, did anyone else notice that when the Segwit2x Coin came out it had a zero market cap value and it almost hit $2,000 per coin... i believe its trading around 5 or 6 bucks right now. But yeah check this out you guys n gals.

<center>  </center> <center>So segwit2x is about to come out right.. well this is my own thought on how I should do some crypto fondling..what I was thinking is, steem dollar moves with the price of bitcoin... so I’m not worried about bitcoin, though I do see ethereum having abit of a downer... I was thinking that.... I just throw my money in to ethereum and Neo ....why, because a lot of people are gana go for bitcoin now and I’m hoping if I’m right, that bitcoin price will pick up...and ethereum will go down abit more.. than after the segwit2x wave... alot of people will go back in to ICOs than back in to Altcoins.. that’s what I feel will happen and what my sort of strategy will be, due to the fact that it seems to be an on going cycle... plus I really have high hopes for ethereum this year.. specially the ICOs are helping ethereum out ...</center> # <center>Fuck it ima try and go all in on ethereum and Neo actually hahaha wish me luck </center> <center></center> <center></center> <center>[source](https://imgflip.com/memegenerator/72621966/Homer-thinking)</center> # <center>Sorry for the short post just wanted to put the thoughts out there instead of holding it in my mine to boil</center> *** <center>Hay guys tryout brave browser and be sure to use my referral if you going to download it thank you </center> <center></center> # <center>http://brave.com/jam075</center>

I stumbled across this and it really amazed me... Ive never seen nothing like it. When the Segwit2x Fork happened check out how the coin did in the markets. I thought i would share this with anyone that didnt know it happened, because i sure didnt..haha

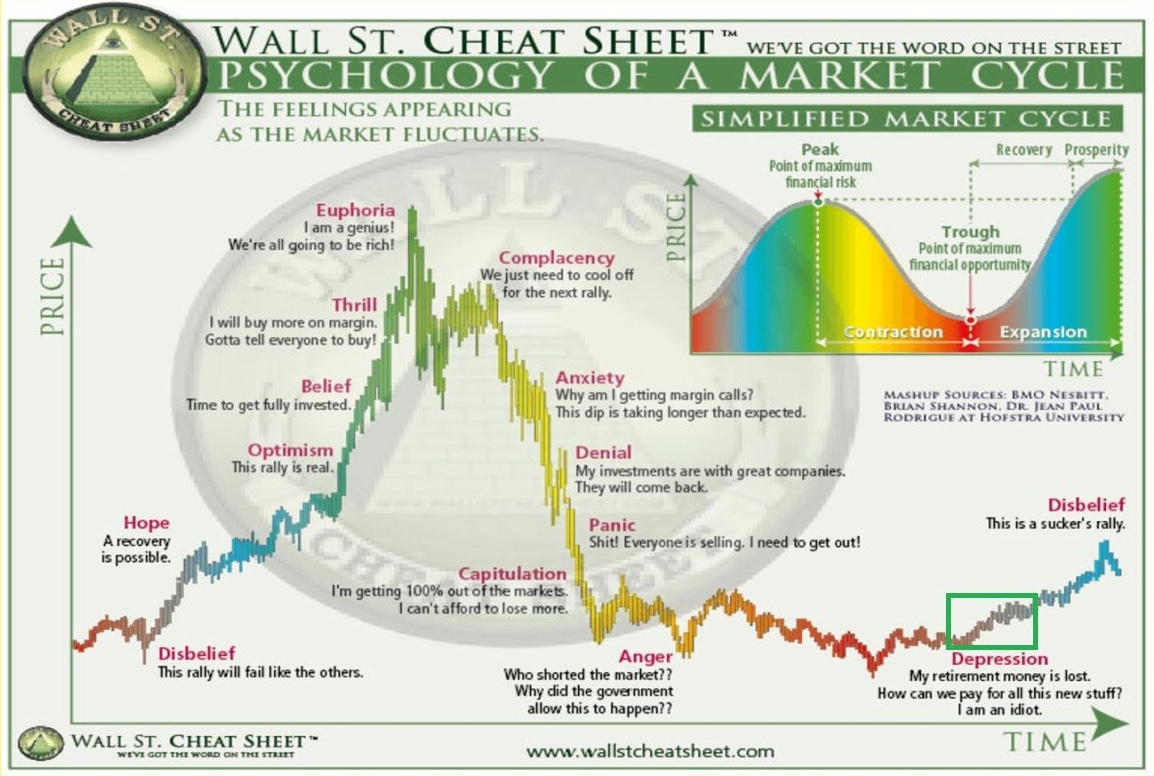

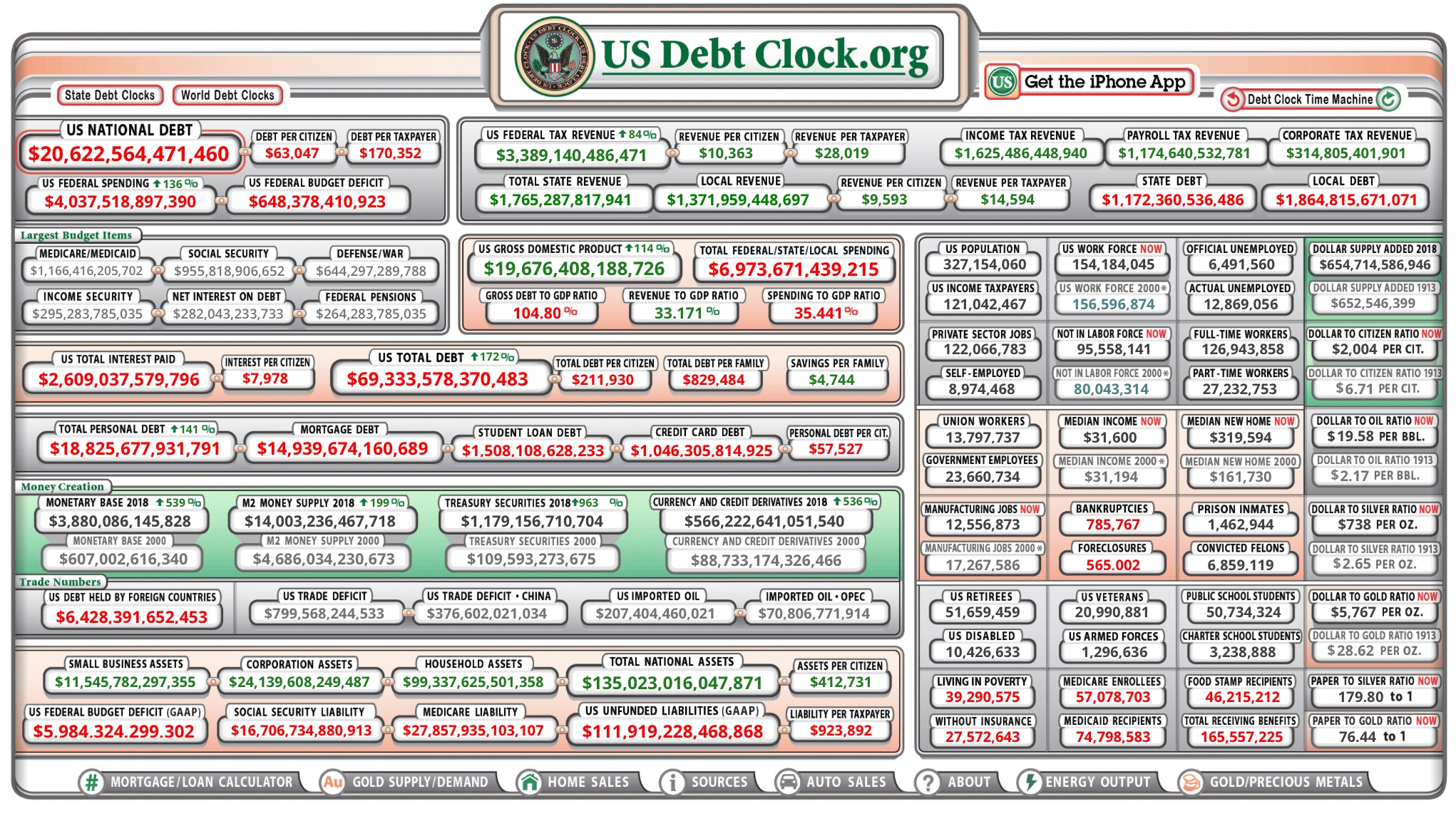

작년말 2,500만원을 찍었던 비트코인이 하염없이 떨어지고 있습니다. 항간에는 미국달러 기준으로 5,000달러 얘기까지 나오고 있는데, 그중 그냥 지나치기에는 근거가 있어 보이는 몇가지를 적어보려 합니다.  이것은 폭등이나 폭락이 있을 때마다 제가 열어보는 다이어그램입니다. 원래는 주식쪽에서 쓰였던 것인데, 단계에 따른 투자자들의 심리적 변화가 거의 정확히 나와 있습니다. 지금쯤은 Anger(화가남)를 지나서 Depression(우울함)단계를 지나고 있는것 같네요. 저는 암호화폐와 블록체인의 성장가능성을 보았을때 이번 폭락도 극복할거라 생각하지만 그래도 추가하락을 가져올 수 있는 몇가지 우려스러운 부분은 짚고 넘어가려 합니다. **첫번째는 비트코인의 세그윗 재개 여부입니다.** 송금 처리속도가 사상최악인 현재 비트코인 블록운영 상태는 추가하락을 불러올 수 있는 요인입니다. 처리지연 문제로 비트코인을 떠나 이더나 알트로 이탈한 투자자들이 더이상 비트코인으로 돌아올 이유를 못찾는다면, 정말로 이더에게 왕좌를 내주는 일이 발생할 수도 있습니다. 이더리움의 시총이 비트코인을 넘어서는 일도 가능한 시나리오입니다. 게다가 이더는 분산 애플리케이션인 DApp의 흥행으로 빠르게 생태계를 장악해 가고 있으니까요. 다들 아시는 것처럼 작년말 예정되었던 세그윗2x는 비트코인 코어팀을 비롯한 다수노드들의 이탈로 무산되었습니다. 우지한과 같은 갈등요인에 대한 항의표시라는 것이 표면적인 이유지만, 어떻게든 비트코인의 비정상적 폭등을 저지해 보려는 여러 노드들의 의사가 반영된 것이 크다고 봐야 합니다. 세그윗을 통해 블록 용량이 커지면 처리속도가 빨라지고, 당연히 더 많은 거래가 가능하니 가격상승에 불을 붙일수도 있었습니다. 시각에 따라 다르겠지만 저는 개인적으로 세그윗 무산이 그나마 비트코인의 파국을 막았다고 봅니다. 산이 높으면 골짜기도 깊은법이니까요. 어쨌든, 지금의 상황을 보자면 세그윗 무산에 따른 부작용도 만만치 않은 것이 사실입니다. 1월에는 비트코인 송금에 3일이 걸린적도 있으니(수수료 이슈가 있긴 했습니다) 이 상태로는 암호화폐라 하기 어려울 정도의 수준이죠. 처리속도라면 남부럽지 않은 리플이 폭등(?) 한것도 비트코인이 한몪 했다고 볼 수 있습니다. 그런데, 비트코인은 언제까지 1메가 블록을 고집할까요? 저는 개인적으로 곧 세그윗 재개에 대한 목소리가 커지고, 결국엔 단행될 것이라 생각합니다. 이미 세그윗2x는 인스톨이 되어있으니 노드들의 82%가 동의만 한다면, 시간문제가 될 가능성이 높습니다. 그 이름을 3x로 바꾸든 4x로 바꾸든 곧 진행된다에 한표 걸겠습니다. 만약 블록용량을 늘리는 세그윗이 물건너 간다면 비트코인의 상승에 걸림돌이 될 것이고, 그 여파를 알트코인들까지 고스란히 떠안게되는 상황이 펼쳐질 수도 있습니다. 그런 상황이 바로 세그윗으로 대표되는 비트코인 처리속도 해결에 대한 이슈입니다. **두번째는 USDT문제입니다.** 아시는 분들도 계시겠지만, USDT란 놈이 실은 중국인들에 의해 만들어진 환전코인입니다. 저도 해외거래소에서 그냥 달러라 생각하고 편하게 이용하는 편인데요. 실은 캐릭터도 없이 무미건조한 이 USDT에 각국의 금리, 환율정책이 맞물린 복잡한 사정이 숨어 있습니다. 특히 미국과 중국의 관계는 좀 심각합니다. 대부분의 코인투자자들은 탑셀러가 아닌 이상은 수익금을 현금화해 재투자하거나, 현금으로 환전해 사용합니다. 이 과정에서 전세계적으로 가장 많이 이용되는 코인이 USDT라는점 알고 계실겁니다. 이렇게 코인투자자들이 환전을 목적으로 사용하는 것에는 아무 문제가 없습니다. 비트코인 송금이 하루씩 걸리는 것에 비하면 말이죠. 문제는 이것을 현금으로 바꿔주는 은행들과 각국 정부의 이해관계가 복잡하게 얽혀 있다는 것입니다. 현재 세계 통화의 왕노릇은 미국 달러가 담당하고 있습니다. 금태환을 없애고 엔화환율을 강제로 높인 다음, 힘으로 얻은 왕좌인거죠. 그래서 당분간이란 의미로 담당이라 표현했습니다. 사실 기축통화라는 것은 그 나라의 자본규모와 자본역사도 중요하지만, 그 보다 더 중요한 것은 군사력, 즉 힘입니다. 일본과 독일을 힘으로 누르고 기축통화의 왕좌를 차지한 미국의 경우를 얘기하는 것입니다. 그런데, 중국 경제와 군사력의 성장은 미국의 독주에 브레이크를 걸게 되고 미,중 환율전쟁의 원인이 된것입니다. 간단히 요약하자면, 미국의 국가부채는 이미 자신의 힘으로 갚을 수 없는 수준에 이른지 오래입니다. 미국의 국가부채를 실시간으로 집계하는 사이트입니다. 현재 20조 달러를 넘어선 것으로 나옵니다. 2경1730조원으로 계산되네요. 미국의 GDP가 19조 달러니 일년동안 생산한걸 다 쏟아부어도 못갚는군요. 지난 수십년간 기축통화로서 한,중, 일 아시아 산업국의 자동차, TV, 스마트폰 등 물건들을 사들인 결과입니다. 어찌보면 종이에 불과한 달러를 풀어, 실물을 확보한 것이죠. 이렇게 유지되던 미국 통화정책은 트럼프의 등장과 함께 변경됩니다. 미국 제조업 부활과 보호무역으로 대표되는 트럼프의 정책은 그동안 돈을 풀어 세계경제를 돌아가게 만들던 것과는 정반대의 상황을 가져오게 됩니다. (게다가 작년 10월부터 미국 연준은 금융위기 이후 풀린돈들을 회수하기 시작합니다)  http://usdebtclock.org 이런 상황에서 미국으로서는(트럼프로서는) 중국이 눈엣가시일 수 밖에 없습니다. 일본처럼 힘으로 눌러 환율을 포기시킬 수 있는 대상이 아닌데다가, 위안화 가치를 올려 중국 수출에 타격을 주고 미국제품을 미국인들이 쓰게 해야 하는데, 그걸 할 수 없으니 말이죠. 이 와중에 비트코인이 세계경제의 중심에 등장하게 됩니다. 중국은 암호화폐 자체를 금지시키고 있는데, USDT는 중국에서 만든것이고, 암호화폐는 세계 어디든 유통될 수 있으니, 여기까지만 보아도 문제가 있는 상황인 것입니다. 물론 지금은 암호화폐의 시총이 많이 줄었지만, 작년말 삼성 시총을 넘고, 올해초 구글 시총을 넘어 애플을 넘기 직전까지 갔을 때는 정말 아찔하더군요.  제가 집계하던 암호화폐와 세계 100대 기업 시총 비교표입니다.(1월8일까지 집계하다 말았군요) USDT는 위안화를 달러로 바꾸는 매개 역할을 한 것이므로, 결국 위안화로 달러를 산것이 됩니다. 이 경우 규모가 더 커지면 문제가 될 소지가 큽니다. 중국 입장에서는 해외로 위안화가 빠져나가는 것이니, 신경을 곤두 세울 수 밖에 없고, 미국 입장에서는 가뜩이나 중국이 달러를 많이 가지고 있는데, 그 규모가 더 커지기 때문이죠. 하지만 위안화 가치를 올려야 하는 현재 미국의 입장에서는 크게 문제 될게 없는 장사입니다. 결국 달러는 미국으로 흘러 들어오게 되니까요. 이 이슈의 문제는 오히려 중국에 있습니다. 모바일결재 활성화로 종이돈을 안쓰기 시작한 중국은 발빠르게 자체 디지털화폐를 만들려 하는데, 비트코인 열풍이 걸림돌이 된 것입니다. 정확히는 국가와 상관없이 누구든 화폐를 찍어낼 수 있는 비트코인의 철학자체가 문제겠죠. 지금쯤은 어떠한 상황을 시뮬레이션해도 암호화폐를 막을수 없다는걸 알게 됐을겁니다. 그렇다면 이용해야 하는데, 중국은 미국의 압력에 대항해 환율을 방어해야 하므로, 당분간은 암호화폐 규제 카드를 이용할 수 밖에 없는 것입니다. 중국을 타겟으로 한 제2 플라자합의 가능성도 있는 만큼 미,중 양국이 암호화폐라는 카드를 어떻게 사용하느냐에 따라 앞으로 이 시장의 큰 변수로 작용 할 수 있습니다. **세번째는 JP모건과 골드만삭스 입니다.** 비트코인의 시카고 선물시장 상장 이후 기관들의 유입소식이 간간히 들려옵니다. 물론 작년 JP모건회장의 무지에서 나온 코미디같은 상황도 있었지만요. 세번째 이슈는 다음 포스팅에서 다루려 했던 주제라 간략히 요약만 하고 넘어가겠습니다. 암호화폐와의 연관성을 알기 위해서는 두 기관의 특성을 살펴 볼 필요가 있습니다. 간단히 말하자면 ‘돈되는 것은 다 한다’로 요약할 수 있습니다. JP모건 회장이 사기발언을 후회한다고 말한것은 ‘돈되는 것을 못알아 봐서 미안하다. 후회한다’는 취지로 이해하면 될 듯합니다. 이 두 기관의 공통점은 또 있습니다. 공매도라는 자본시장의 필살기를 아주 잘 구사한다는 점입니다. 전세계 어디든 전쟁과 금융위기에는 이 두회사가 항상 끼어 있었으니까요. 지금쯤 저점매수를 할 시점일 수도 있지만, 그들의 관점에서는 어떻게 보일지 모르겠습니다. 단, 아직 암호화폐를 충분히 확보한 상태는 아닌걸로 보이기 때문에, 앞으로의 시장전개에서 암호화폐 탑셀러들과의 대결이 기대되긴 하네요. 어떻게 보면 이들은 수 십년간, 아니 수 백년간 세계자본시장의 틀을 만든 장본인이라 해도 과언은 아닌듯 합니다. 이들과 대항할 10년도 안된 블록체인 신흥부자(?)들의 치열한 경쟁이 정말 기대됩니다. 코인판은 기존경제와는 작동원리가 다른점이 분명히 있으니까요. 이 기관들이 시장장악을 위해 좀더 떨어뜨리고 진입할 가능성도 있다는 것이 세번째 이슈였습니다. 첫 포스팅을 너무 장황하게 한것 같네요. 오랜만에 블로그에 글을 쓰려니 아직 적응이,,, -_-‘ 다음 포스팅은 심플하게 해보렵니다.

<b>Exclusive Interview with Trace Mayer on Bitcoin and the Segwit2x Fork</b> <iframe width="560" height="315" src="https://www.youtube.com/embed/JLRF-q9gm4I?rel=0&showinfo=0" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe><br> Interview With Trace Mayer – Talking about the Segwit2x Fork. The Segwit2x release at block 494784, was expected to occur around November 18, 2017. Tune in each week as Tony and Gary bring you great information to help you learn as they learn about Bitcoin, Mining and other digital currencies. Make sure and visit https://CryptoCousins.com to see their videos and more information. <b>SUBSCRIBE TO THE PODCAST TODAY:</b> <b>iTunes</b> - https://CryptoCousins.com/iTunes <b>Spotify</b> - https://CryptoCousins.com/Spotify <b>Android</b> - https://CryptoCousins.com/Android Call with your questions at <b>(747) 777-9471</b> <b>GET $10 WORTH OF BITCOIN FREE:</b> Create an account on Coinbase using the affiliate link @ https://CryptoCousins.com/Coinbase & when you buy your first Bitcoin you and I will both receive $10 worth of Bitcoin FREE. <b>Bitcoin:</b> 3F55vdBpfu5HAg7YWpLHv2mRj3ojUzVR3 <b>Etherium:</b> XsVNiigwD8gqAtwgaPbFQ5im69JGGs3q97 <b>Litecoin:</b> LN9EGRWGP2fEyY2dNTMijiiDR7Y4sW357df <b>The Crypto Cousins On Social Media:</b> <b>YouTube</b> - https://cryptocousins.com/Youtube <b>Facebook Group</b> - https://cryptocousins.com/facebookgroup <b>Facebook Page</b> - https://cryptocousins.com/Facebook <b>Twitter</b> - https://cryptocousins.com/Twitter <b>Telegram</b> - https://cryptocousins.com/Telegram <b>Discord </b>- https://cryptocousins.com/Discord See a full list of <b>Crypto Wallets</b> at https://WorldWideWallets.com See the <b>Ethan Mining Machine</b> at https://TurnkeyMining.com <b>DISCLAIMER:</b> The Crypto Cousins Podcast and website information are not intended as investment advice, and only contain our personal opinions. Cryptocurrencies are risky. Never invest more than you can afford to lose. Always seek professional advice before making any investment. Investing in Bitcoin and other Crypto Currencies presents both tremendous risks as well as tremendous opportunities. You understand that you are using any and all Information available on or through The Crypto Cousins Podcast at your own risk.

<center><a href='https://d.tube/#!/v/manuelsyed/oarwleip'><img src='https://ipfs.io/ipfs/QmciW8mw1BNfiFsPpmRmJqpCB1LMicQpR1WMxtinCpXnhj'></a></center><hr> Das Video wurde am 13.07.17 auf YouTube veröffentlicht - https://ms.world ▪️STEEM BLOG https://steemit.com/@manuelsyed ▪️YOUTUBE https://www.youtube.com/channel/UCB6uwtr3EkcMTeygGt0Wg7g ▪️FACEBOOK https://fb.me/manuelsyed ▪️INSTAGRAM https://instagram.com/manuelsyed ▪️TELEGRAM CHAT CHANNEL https://telegram.me/querdenkerchat ▪️TELEGRAM NEWS CHANNEL https://telegram.me/querdenkernews ▪️KONTAKT kontakt@ms.world <hr><a href='https://d.tube/#!/v/manuelsyed/oarwleip'> ▶️ DTube</a><br /><a href='https://ipfs.io/ipfs/QmY5evYBBjQbffVMejxicLsa7QKuQsUqPgqbD5S3zKH1QP'> ▶️ IPFS</a>

Dear followers of the SegWit2X and B2X currencies, we have incredible news for you. The SegWit2X team is launching a series of reward campaigns, which give Blockchain developers the opportunity to show how skilled they are and reward the best projects, ideas and solutions with large sums of money. https://i1.wp.com/criptotendencia.com/wp-content/uploads/2018/01/Segwit2x-Campa%C3%B1a-Bountry.jpg?resize=1024%2C600&ssl=1 We deeply believe in the technologies and the people who make them. The purpose of the SegWit2X Bitcoin fork is to develop the Blockchain technology in general. We look forward to meeting the outstanding Blockchain enthusiasts for greater joint cooperation. The 3 campaigns that we plan to execute are the following : 1- B2X Applications Contest (the total prize fund - USD 70,000) The goal of the rewards campaign is to motivate developers to create applications compatible with B2X. This could be any type of application that represents various industries that operate in the B2C sector. The duration of the campaign is 3 months, the expected number of winners varies from 1 to 5 and the total prize fund is US $ 70,000. Its applications could be compatible with any cryptocurrency, but the implementation of B2X is mandatory. The applications could fall within the following criteria: Work solution ready to use. The best concept, non-trivial solution. It could be a mobile application (Android / IOS), a web application or a browser application. 2- Bug Bounty B2X (the total prize fund - USD 30,000) This reward campaign is divided into two criteria: Find vulnerabilities in the web service (the reward varies from US $ 50 to US $ 5,000 in B2X). Find vulnerabilities of B2X code (the reward is US $ 5,000 in B2X). 3- B2X Improvement Bounty (the total prize fund - USD 20,000) The objective of this contest is to improve the SegWit2X project. The best solutions with the detailed description of the code will receive important rewards in B2X. To get more information about the rewards campaigns we are carrying out and get the details of the technical side of the project, visit our official website and follow our latest news through the social channels of Telegram and Twitter . This content comes courtesy of SegWit2X .

Bitcoin has been plagued by numerous technical obstacles, which have become more apparent in conjunction with its surge in value. A crucial problem for any blockchain-based cryptocurrency is how to scale it while maintaining a decentralised network. This has been an issue within the Bitcoin community, culminating in a “civil war” between Bitcoin Cash and the original Bitcoin. Bitcoin transactions are currently expensive and can take hours to be verified on the blockchain, making it difficult to use for quick payments. Once a scaling solution has been implemented on the blockchain, however, Bitcoin will become easier and cheaper to use – functioning as “digital cash”. Bitcoin Cash and SegWit Bitcoin Cash was born out of the idea of increasing blockchain block size to process more transactions. By increasing the block size, the number of transactions processed per block increases and more transactions can be included in the same amount of time. There are several drawbacks to this scaling method, though, which is why the Bitcoin Core community opted to pursue other scaling solutions. SegWit (Segregated Witness) has now been implemented on the main Bitcoin blockchain, and aims to effectively increase block sizes to 1.8MB while removing the malleability of transaction IDs. This upgrade is backwards-compatible with previous transactions on the Bitcoin blockchain and paves the way for the implementation of the Lightning Network – a scaling solution which requires un-modifiable transaction IDs to retain security. SegWit is currently being implemented by Bitcoin nodes around the world, but will not be able to solve the scaling problem singlehandedly. For that, many Bitcoin advocates have placed their faith in the Lightning Network. Lightning Network The Lightning Network plans to solve the blockchain scalability problem by implementing an off-chain solution which uses the security of the blockchain to periodically verify payments. Off-chain scaling solutions have great potential for improving the transaction capacity of blockchains, as they only periodically settle their transaction record on the chain while computing transactions on a separate, linked network. The Lightning Network works by creating payment channels between users and using its second-layer network to process transactions between users with open payment channels. Payment channels exist as smart contracts on the Bitcoin blockchain, and can be used by Lightning Network users to settle their transactions on the actual blockchain. Participants with open payment channels form a decentralised second-layer network which offers instant transactions with extremely low fees, making it preferable for Bitcoin users to open Lightning Network channels and send money over the second-layer network. The successful implementation of the Lightning Network on the Bitcoin blockchain will open the cryptocurrency to a new world of applications and make it as spendable as fiat currency. The Lightning Network is expected to be implemented on the Bitcoin blockchain this year, with developers testing payment channels and finalising the network’s architecture.

.jpg) During the course of 2017, we saw big technology players making moves in blockchain. In addition to Microsoft and IBM, Oracle announced in October a new cloud-based blockchain-as-a-service offering, while SAP opened up early access to its own version of the offering in May. With these updates, and others, it's safe to say that Fortune 500 companies are now pairing with providers to explore blockchain’s uses in their businesses These are examples of the type of adoption and validity we expected to see in 2017, but even these positive developments can still be considered scratching the surface. Government bodies are also collaborating on the many potential benefits of blockchain, and bold entrepreneurs are thinking about how the tech can be used as the basis for new smartphones and apps. Even the recent frenzied nature of bitcoin – which has stunned the investment community and has caused both scorn and praise – can’t disrupt the ongoing progress of blockchain. While we follow bitcoin's journey, let's look ahead at what we can expect to see unfolding in 2018: 1. Asia and the Middle East will aggressively push blockchain Interest in blockchain continues to be very high in Asia and the Middle East, where some of the largest banking institutions are forging ahead with blockchain projects or service offerings, particularly in payments. For example, banks in Japan and South Korea have just begun testing a blockchain technology that could achieve same-day international transfers and cut costs by nearly 30 percent. 2. Cybersecurity will amplify blockchain adoption With the rise of ransomware attacks demanding cryptocurrencies, blockchain and IoT cybersecurity will emerge with defenses based on cryptocurrency technologies. While this may sound fantastical and futuristic, the emergence of blockchain cybersecurity tools may be the next big thing in blockchain. With major breaches such as Equifax proving that companies generally cannot safeguard current identity data systems, the need for a more secure blockchain-based identity approach, in which no one holds all the keys, will emerge. 3. ICOs will take off There was a seismic jump in ICOs in 2017, and the ecosystem of cryptocurrencies has expanded in a huge way. In the next year, the pace of ICOs will grow significantly faster, and will overtake venture capital funding. 4. Finance and insurance will go all in The insurance and finance sectors are two of the most likely to experience deep, and threatening, disruption from blockchain technology. Insurance will emerge as a hot area as claims processing and complex multi-party processes like subrogation will show the business value of blockchain-based automation. And, JPMorgan will open a cryptocurrency trading desk, despite Jamie Dimon's viral comments dismissing the validity of cryptocurrencies. 5. Automation, privatization are coming Blockchain will drive digital transformation of the enterprise specifically with automation, digitization of processes, tokenization of physical assets and activities and codification of complex contracts. In addition, governance issues will continue to plague bitcoin (Segwit2x), ethereum (frozen Parity funds) and others as new challenges emerge. This will drive enterprises to "private" blockchains but will not slow down the growth of core cryptocurrencies.

I'm not talking about the monetary value of Bitcoin as it's awesome price wise right now. The biggest issue is the sheer volume of unconfirmed transactions out there on the blockchain which is driving the fees up exponentially. Bitcoin was originally touted as having low transaction fees, looking back many moons ago that would have been the case. Now it's laughable. No wonder many businesses are no longer accepting Bitcoin because of the high fees and the length of time it is now taking to confirm transactions. It's time to move forward and not be afraid of adopting Segwit2x and the lightening network. It's great having guiding principles, however it is dangerous to keep going back to those principles when you are trying to take Bitcoin mainstream, a compromise is needed for Bitcoin to be adopted by the masses

Hi Steemians ,,, following @indoksi will give you a little information about SegWit2X. SegWit2X is an update on the system to overcome the problem of block size restrictions that reduce the speed of Bitcoin transactions. After being officially discontinued in early November 2017, SegWit2X appears to be performing again, with support teams deciding to go ahead with a fork on December 28, 2017. Proposed as a solution to the bitcoin scale problem, SegWit2X is agreed on the New York agreement and is supported by many big names and corporate entities. However, the bitcoin core community thought of it as an attack on the original series in Bitcoin, and after a lot of back and forth and drama, Mike Belshe, CEO of Bitgo, posted a hard fork cancellation letter containing: "Our goal is always to make a smooth Bitcoin upgrade. Although we believe that in the end we need a larger block size, but there are more important things that we believe in: Creating a community is always together. Unfortunately, it is clear that we have not made enough consensus to increase block size at this time. Continuing this path can make the community split and will hinder the growth of Bitcoin. It's never been a SegWit2X destination. " SegWit2X itself has a problem, the proposed method to increase the size of bitcoin blocks from 1MB to 2MB requires non-backward software upgrades While SegWit2X like "put to sleep" by the original supporters consisting of founders start up and miners. Now a new site has emerged with four members of the Jaap Terlouw leadership team, which plans to do the fork. Fork is now supported with some changes such as the hitBTC that supports BTC hard fork work system and IGNIS airdrop. And also exchange with a turnover of more than 1 billion dollars per day.

A number of Bitcoin companies and miners have agreed to run code that will implement a hard-forking increase to the non-witness data in blocks roughly three months after the activation of Segregated Witness (SegWit). According to some of its proponents, the proposal, known as SegWit2x, is said to be the only viable solution to the Bitcoin scaling debate. However, agreeing to initiate a hard fork without knowing how speculators will react to such a change comes with risks. If there is not full support for the hard fork from bitcoin holders, the end result could be a split of Bitcoin into two separate cryptocurrency networks, which could cause extreme brand confusion among the general public (depending on the severity of the split). In addition to the potential risks of a permanent split of the community, SegWit2x also ignores tools that could be used to get the intended benefits of this particular hard-forking increase to capacity without the possibility of a network split. Perhaps most troubling, SegWit2x ignores the reasons as to why Bitcoin is useful in the first place. Speculators Call the Shots While the original Medium post regarding the New York Agreement claimed the signatories accounted for $5.1 billion worth of monthly on-chain transaction volume (more than half of the entire network for April), the general view of SegWit2x from bitcoin holders is unclear at this time. Companies representing large amounts of bitcoin holdings (Digital Currency Group, Coinbase, Xapo, etc.) have signed onto the agreement as well, but we have yet to see speculators have the chance to set a price for the hard-forked chain. As of now, the hard-fork portion of SegWit2x appears to be contentious, which means exchanges are likely to list both the original chain and the chain with a hard-forking increase to the block size limit. Companies that take custody of their users’ bitcoins will need to allow their users to withdraw both coins. Although more than 80 percent of the network hashrate has agreed to run the SegWit2x code, it’s possible that speculators will prefer the non-hard fork chain. It’s also possible that a futures market could illustrate this point before the hard fork takes place. Of course, miners could decide to mine at a loss and not listen to the market, which would theoretically go against the incentives of the Bitcoin system. If miners abandon the chain preferred by users, it’s possible that a proof-of-work change will be needed, as faith in the current miners may be lost. Such a scenario could be disastrous for Bitcoin, which means miners (and everyone else in the ecosystem) should be incentivized to avoid it. But we’ll have to see what happens. If These Companies Control Bitcoin, Then a Public Blockchain is Not Needed The point of Bitcoin is that it allows everyone to have full control over their money without the need for a trusted third party. There is no third party in Bitcoin because no one controls the consensus rules. If someone is in control of Bitcoin’s consensus rules, then they’ve effectively become the third party that the system was designed to avoid in the first place. With the New York Agreement, the signatories are basically saying they control the rules of Bitcoin (or at least the fork of Bitcoin that they’ve all agreed to run). If that’s the case, then the need for a public blockchain is less clear. Users would effectively be trusting these institutions with the rules of the system and ordering of transactions because they could decide to completely change the rules via a hard fork at any point in time. If the system is no longer trustless, Sybil attacks on the state of the blockchain can be thwarted by having trusted entities sign blocks rather than miners. With that in mind, it may make more sense to launch a federated sidechain pegged to Bitcoin’s main chain instead of trying to turn the main chain into a trusted system. This would allow the main chain to retain Bitcoin’s core value proposition of permissionless money while the sidechain can process the microtransactions these companies desire. The signatories of the New York Agreement could become the functionaries of the sidechain, where they’d control the consensus rules and sign blocks. This sort of setup makes much more sense if users are supposed to trust these entities anyway. A much more efficient transaction network can be created when proof-of-work and decentralization are thrown out the window. In fact, this is exactly what Blockstream’s Liquid sidechain is supposed to achieve early next year. Ironically, some of the signers of the New York Agreement are supposed to be participants in Blockstream’s upcoming federated sidechain. If there are no goals for SegWit2x other than increasing capacity on the Bitcoin network, then a federated sidechain is a much better alternative. There’s no risk of a chain split, capacity can be increased exponentially higher than the twofold increase offered by the hard-fork portion of SegWit2x, and other features, such as Confidential Transactions and faster block times, can also be implemented. Put in this perspective, SegWit2x is completely nonsensical. I’m not sure what the New York Agreement will lead to over the next few months, but it appears to be unnecessarily risky. This article is a guest post by Kyle Torpey. It does not necessarily reflect the views of BTC Media or Bitcoin Magazine.

The controversial Segwit2x scalability proposal was officially canceled in August, but that does not mean that its old developer is giving up keeping the code base available. In fact, Jeff Garzik, better known as CEO of Bloq, who started the project, now believes that his earlier work can be revived in a way that promotes interoperability among the increasingly fragmented set of protocols (see: bitcoin , bitcoin cash and bitcoin gold, bitcoin god). And in a new interview, he revealed that he is working on the upcoming software updates, called BTC1. While he admits he is not sure how successful his work will be, Garzik believes he is bound to unify a bitcoin developer community. Garzik says: "I hope that joining multiple networks into one software, in some way, attracts multiple developers from multiple communities." The BTC1 code is associated with Segwit2x, an attempt to change the rules of the bitcoin protocol, proposed by companies and miners at a meeting in New York in May, the agreement required that the block size parameter be increased to 2MB, at the same time as presses for an update called Segregated Witness, designed to improve and expand the bitcoin block size.