**LIST OF TUTORIALS**

** USING TRADINGVIEW**

*Tools on the left side

*Tools in the upper area

*Screener

*Tools on the right side

*Alerts

**Tools on the left side**

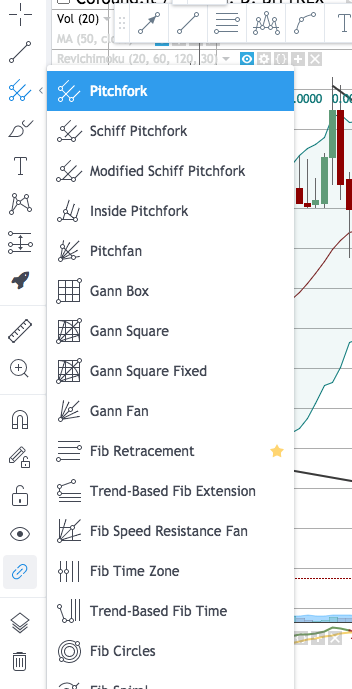

The left side is for drawing cartoons. Most interesting stuff here for me are:

*Lines and arrows to draw the trends and project further price moves.

*Fib retracement and Fib Speed resistance fan. Both of them to predict targets based on supports and resistances of the

*Fibonacci index.

*XABCD pattern and the different Elliot Waves patterns so you can have a more accurate picture of the long term moves (or to study past ones), applying them over the chart.

*Long/short position will provide you the risk reward of the move you are planning to trade.

*Date range and price range will help you to measure the moves in terms of bars/days and % of price move.

If you flag your favorite tools with a star you can add them to an easy access toolbar so you don’t have to look for them when charting fast.

**Tools in the upper area**

This zone is to adjust the different parameters we are using, choose the markets, timeframes…the most interesting tools for me here:

*Markets (choose always the ones with more volume)

*Timeframes, my favs are 1D, 6Hr and 2Hr in that order.

*Candle style, I use the common ones (Japanese). But Heikin Ashi is also an interesting option.

*On chart properties you can adjust colours and scales. I prefer linear scale but for parabolic moves, log is the way to go (oh, parabullic Bitcoin memories)

*The scale icon is to compare charts at one sight. Pretty useful to find correlations between coins or to check few coins from the same market area.

*Indicators

Current indicators that I’m using:

**Volume**: Sounds obvious buts it’s really relevant to track it in order to follow the price action.

**Moving Averages**: I tried some of them but personally my favourites are MA50 and MA100. They work pretty well to spot trends without noise. They could also, sometimes, work as support or resistance. Sometimes I also use the exponential ones, specifically EMA50 and EMA200

**RSI Stochastic**: Useful indicator to track trend moves, spotting the oversold and overbought areas. During a bear trend, it tends to be weak in my experience.

**MACD (CM_Ult_MACD_MTF standard config)**: As described in the lesson here the crosses between MA’s reveal possible reversals. This one in particular is quite graphic. I changed the colours and deleted some noise to make it simpler.

**WT Oscilator (by lazy bear)**: I’m not using it too much lately, because during bear trend it’s showing to be weak. But during accumulation/bull works pretty well. Combined with the RSI, it will provide strong signals.

**TD Sequential (by glaz)**: Only works well with big caps like BTC or ETH. Useful to spot the stage of the current wave. I use it because all info are always welcome but not one of my favourites.

**Ultimate Oscillator (UO)**: I started to use it recently so I don’t have a proper experience to determine its utility. Working well for now to determine the push potential.

**Bollinger Bands**: Also weak during bear trend. But they work pretty well to establish channels for price moves. Also the squeezes would signal a move on the way.

**Ichimoku Cloud (Revichimoku script with 20,60, 120, 30)**: This change is to adapt the configuration to a 24/7 market as crypto is. Ichimoku is useful to spot trends and also find price action zones (support/resistances). I deleted the spans because add too much noise and I do well just with the clouds.

SMA’s (6 and 18): For short term trades price moves. Lately I’m not using them, but also mentioning because it was useful for me, sometimes ago.

I consider totally necessary to refresh the results and try new indicators every now and then. If we stay stick to just a bunch of them we could be missing a lot of opportunities. I don’t use all them always, because sometimes we have to think from a time efficiency perspective. But it’s a good exercise to check their results in a spreadsheet or paper.

**Look for a new indicator (for you), learn about it and apply the signals over the paper, wait and check if played out well or not. Type the results. Repeat. Take conclusions about its performance.**

**Apply the indicators in different timeframes. Being key for me 2Hr, 6Hr and 1D. The more confluence between timeframes the stronger would be the signal.**

To learn and understand the indicators you are using will increase your confidence in the trade.

**Screener**

We can find this one on the bottom left side. By clicking it, it will open the whole display where you can track all the coins and it’s moves based on several parameters.

*Under Overview tab you can see the price changes and an overall rating about the trade recommendations. For me this one is not interesting at all.

*The Performance tab, as the name says, will show you the price change of the coin by day/week/month/year. This is interesting for tracking purposes or statistics but not really useful to trade.

*Oscillators tab, here we talk. Here you can find an overall rating based in the oscillators performance which is interesting to get a first approach. Then you can go deeper checking the levels for each parameters. You will find some predefined indicators but you can add your favourite ones by clicking in the last column (3 dots). My favourite ones here are MACD, RSI, Sar, EMA’s and Ichimoku (I change the configuration depending on the coin and trade setup)

*On the Trend-following tab you can spot the same workflow as in the previous one. In this one my main indicators are the default ones (all the SMA’s ranges) and the Bollinger Bands.

*Then you have more Pivot point parameters but I don’t use any of them. I prefer to set these ones manually over the chart.

On the upper part of the Screener tool you can choose your favourite tabs, save your configuration. Choose your timeframe and set alerts for your picks. And on the right side you can directly apply filters like Top Gainers, Outperformers, Oversold ones…etc.

**Tools at the right side**

Those tools are oriented for social and fast coin tracking. Things I’m using from here:

*Watchlist: Here you can add the coins you are tracking daily so you can get a fast information to the price changes and also access to the charts without typing them in the box.

*Alerts: Here you can find the alerts you set for your coins. I’m using the alerts by right clicking straight in the chart (Add Alert). You can add alerts not just to price moves but also for all the indicators, crosses…etc. Also allows you to configure expiration dates and the way to notify you. Interesting tool if used with moderation to keep mental health haha.

The rest of tools are not for cryptocurrencies market like the events tab. Or are related to social media, PM’s, notifications, your trading ideas…etc. The last one is to trade but I don’t trade using any API so I’m not using either this one.

Happy Trading