<CENTER></CENTER>

<BR/>

I think managing risk is very easy but first it needs to be quantified, and that requires observational and creativity skills. I am talking about risk in the financial sense, I have wrote a complete risk introduction guide here:

* https://steemit.com/economics/@profitgenerator/financial-risk

If you read that guide, then you will understand the general approach to risk, but it also needs to be quantified and analyzed before proper actions are done to lower it. It has to be calculated.

So this post is about calculating it, sort of a 2nd part of the first guide. Let's start.

<br/>

# Risk Calculation

This involves the calculation of the potential damage caused by the risk and the probability of it happening. And if we use a general sort of default expected situation, then it will involve a margin of error.

However I don't like margins of error, so if we were to incorporate always the worst case scenario, then there is no margin of error, perhaps only circumstantial, that would involve other factors.

**Let me give you an idea what I am talking about:**

* Say you play heads or tails, you have a 50-50% of winning or losing, your win amount would be 1$+ the bet, and your loss amount 1$. Okay so the general risk here is 1$ in the damage sense and 50% probability in the probability sense. This over the long term is a neutral risk, since it's expected value is 0, thus there is actually no risk in the long term.

* However in the short term we may say that we do it 10 times, and the probability of losing 10 times is 0.098%, and if this would be our max threshold then we would assume a risk of that %, and a max loss of 10$.

* And finally there is the circumstantial unrelated, but affecting risk that maybe the coin is tinkered and actually we'd lose 10 times in a row with 2% probability say, and that over the long term would cause a lot more damage.

Okay so these are the basics, and then you just have to add them together, but it get's more complicated as we dive into markets.

<br/>

# The Method - 1. Setting it up

Now let me show you how the risk of a Bitcoin trade can be calculated. Let's say you want to buy Bitcoin now at 4567.02$.

Just grab [the historical data of BTC](https://blockchain.info/charts/market-price?timespan=all) and let's see what the market stats are. Then use a spreadsheet software, I recommend [LibreOffice](https://www.libreoffice.org/), it's free, and it's decent for this or anything else calculation related.

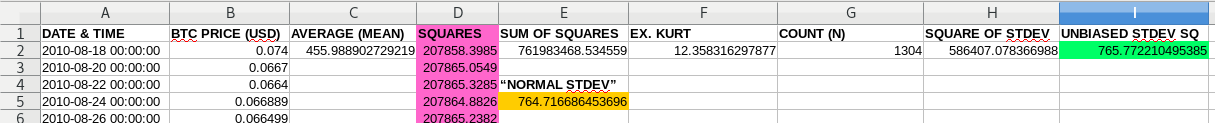

The standard deviation of Bitcoin is `764.716686453696`$, but this is if it were a Normal Distribution which we know financial market's aren't. It's a [heteroskedastic time series](https://en.wikipedia.org/wiki/Heteroscedasticity), but it is my theory that the price eventually converges itself to a "central mean", the sort of reversion to the mean effect. In fact from my quantitative experience, most markets have a volatile start, and they converge to a more stable form logarithmically, and eventually everything dies so it could, over the long term, go back to 0. So it would be a Normal Distribution eventually, but not in the short run.

But anyway the [skew](https://en.wikipedia.org/wiki/Skewness) and [kurtosis](https://en.wikipedia.org/wiki/Kurtosis) has to be accounted for, which can be calculated with this simple formula:

* https://en.wikipedia.org/wiki/Unbiased_estimation_of_standard_deviation

Thus the actual standard deviation of Bitcoin (as of this moment) is: `765.772210495385`$

<center></center>

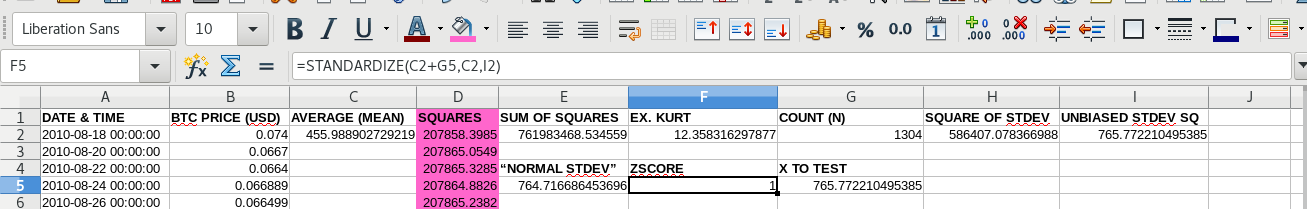

Not a big difference, but why just not be accurate. Now we know that with a [ZSCORE](http://www.investopedia.com/terms/z/zscore.asp), the probability area of our chosen variable, basically it's deviation correspondent. This can be calculated by using the STANDARDIZE() function on the mean+x using the man and our accurate standard deviation.

As you can see, if we input the 1 standard deviation value it gives back 1, that is th ZSCORE of that particular value.

<center></center>

Okay so now that we can calculate ZSCORE and we know the true standard deviation, let’s do the risk analysis.

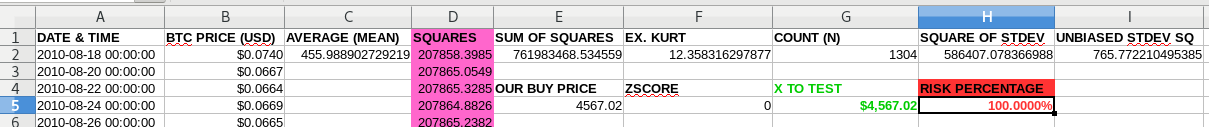

First of all we compare it to the buy price which is 4567.02$ in this example, that is our reference point, so just quickly rewriting the formulas.

`=STANDARDIZE(G5,E5,I2)`

`=NORM.DIST(G5 ,E5,I2,1)*2`

<center></center>

This will calculate the standard deviation value, score and probability area from our reference point, which would be the top price. As you can see if we set it to our buy price, the distance from it is 0 deviations and it covers 100% of the data, meaning that there is a 100% probability that the price will go lower than this.

Now we would set a threshold for maximum risk. They sort of tell that 3 sigma is usually a standard since that would follow from the [Chebyshev's inequality

](https://en.wikipedia.org/wiki/Chebyshev%27s_inequality) a probability of 0.27% or for a daily event, happening once in a year.

Now if we want to trade, we will probably trade for more than 1 year, so we need stricter standards, presumably longer than our lifetime, significantly, so that it will be improbable of happening to us in our lifetime. This way we can catch all stray random events and only work with controlled risk.

So I’d recommend a 5 sigma standard at least. Even in scientific circles they use [5 sigma standard](https://en.wikipedia.org/wiki/68%E2%80%9395%E2%80%9399.7_rule) when they accept evidence for a scientific discovery (yeah guys the Earth is not flat).

So in that case that would be a probability of 0.00005733%, happening on average once every 4776 years. That is a better standard for finance in my opinion. Of course stricter standard can be set too like 7 sigma which would be the quarter history of the planet. But no need since the probability of something else, just as bad is more likely than something of that improbability happening. In fact the probability of us getting hit by a car is much higher, so it is more likely that our investment life will be ended by a car than by a financial loss.

So using a 5 sigma standard our stoploss would be set at 738.16$, and the probability of the price going this low is 0.00005733% .

So we would hold the Bitcoin trade in this example and the probability of losing the entire position (worst case scenario) would be 0.00005733%.

Now this doesn’t mean that we can’t lose less than this with a higher probability, in fact a 20% loss already has a 23.29523615% probability, but that would be unrealized until we don’t close the trade, but we would buy & hold, which would be the most conservative position.

**So basically the question is is it worth buying at 4567.02$?**

And this means that our maximum risk has to be offset by our minimal expected profit!

<BR/>

# The Method - 2. Calculating expectancy

The expectancy formula is the following:

`EXP= WIN% * PROFIT – LOSS% * LOSS`

And we would work with the maximum loss, and the minimum expected profit, to avoid margins of errors and further complications.

This means that a loss of the entire portfolio has an expectancy of -0.0000005733 , this means that any potential profit has to be greater than this to be profitable.

But not so fast, this doesn’t account in the unrealized losses, and the potential profit has a very low probability by itself given that we are near all time highs.

The profit, given the data would be 1.039683426, and it’s probability very low, totalling a profit expectancy of 0.000004128.

That means that the total expectancy is 0.000003555, though positive, but it gives a very small edge, and given the lack of data probably wrong.

Plus this model assumes that we hold forever, either until we hit the maximum or until it hits the stoploss. At which point we are risking the entire position for a very small potential gain, probably not worth it. And again these number are for longterm due to the [law of large numbers](https://en.wikipedia.org/wiki/Law_of_large_numbers), we might just as easily get a loss.

<BR/>

# Conclusion

While it is important to calculate the risk, we also can’t ignore other risks, like what is the probability that the exchange gets hacked? Well that alone should discourage us from taking the position above.

In fact due to the prevalency of exchanges getting hacked all the time ,I’d say any position that can’t potentially give us at least 10-20% ROI is not worth taking just for this reason alone.

Then you have the whole losing the password/private key charade, which further forces us to go for higher ROI.

You know BTC is a risky asset, and to offset the risk, we have to make big ROI, since at the end of the day, that will be our net expectancy.

So each additional risk element increases the negative side of the expectancy formula, and we need bigger and bigger potential profit if we are to end up in profit at the end. Some will get lucky, most won’t, so it’s important for us to always have a potential positive expenctancy.

Otherwise we are just gamblers, and not professional traders/investors.

<br/>

---------------------------

***Disclaimer: The information provided on this page or blog post might be incorrect, inaccurate or incomplete. I am not responsible if you lose money or other valuables using the information on this page or blog post! This page or blog post is not an investment advice, just my opinion and analysis for educational or entertainment purposes.***

------------------------------------------

**Sources:**

https://pixabay.com

-------------------------------------------

<CENTER><H1>Upvote, ReSteem & <a href="https://steemit.com/@profitgenerator" target='_blank'><img src='https://s4.postimg.org/cfz9b1mnh/bluebutton.png' border='0' alt='bluebutton'/></a></H1>

</CENTER>